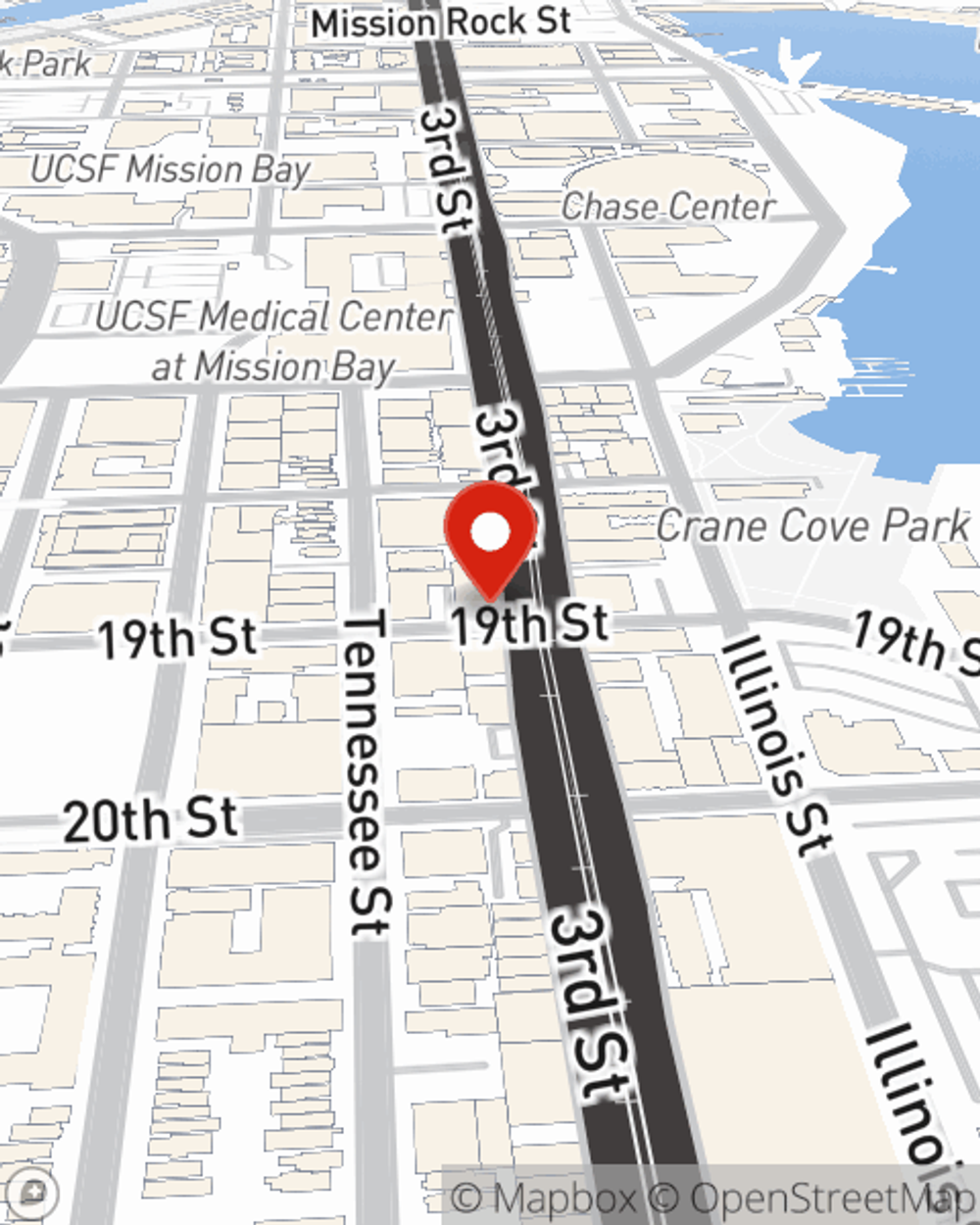

Auto Insurance in and around San Francisco

The first choice in car insurance for the San Francisco area.

Insurance that's the wheel deal

Would you like to create a personalized auto quote?

Insure For Smooth Driving

With State Farm, you can drive with confidence knowing your auto coverage is dependable and reliable. With a number of savings programs such as Multiple Lines and Claim-Free, State Farm aims for its customers to see plenty of savings. Not sure which savings options are available to you? Janet Lin can work with you to double-check your savings options.

The first choice in car insurance for the San Francisco area.

Insurance that's the wheel deal

Great Coverage For A Variety Of Vehicles

Even better—budget-friendly coverage from State Farm is possible for a wide array of vehicles, from sedans to smart cars to scooters to motorcycles.

Reach out to agent Janet Lin's office to learn how you can save with State Farm's auto insurance.

Have More Questions About Auto Insurance?

Call Janet at (415) 621-0140 or visit our FAQ page.

Simple Insights®

Texting while driving includes growing mobile web use

Texting while driving includes growing mobile web use

Texting while driving is one distraction and the use of mobile web services on the road has increased for drivers overall posing an equal or greater concern.

The importance of rental reimbursement and travel expenses when you're on the road

The importance of rental reimbursement and travel expenses when you're on the road

Learn how optional rental reimbursement and travel expenses coverage on your auto policy can help cover costs if your car has a covered loss far from home.

Simple Insights®

Texting while driving includes growing mobile web use

Texting while driving includes growing mobile web use

Texting while driving is one distraction and the use of mobile web services on the road has increased for drivers overall posing an equal or greater concern.

The importance of rental reimbursement and travel expenses when you're on the road

The importance of rental reimbursement and travel expenses when you're on the road

Learn how optional rental reimbursement and travel expenses coverage on your auto policy can help cover costs if your car has a covered loss far from home.